Luc Brunet – 1 April 2013

The Cyprus story took a very interesting turn. As you remember from my previous letter, I wrote that the most probable outcome was a scenario closed to Iceland, with bankrupt and dismantlement of the weak banks. This is indeed what we see happening now, including a guarantee of 100,000 euros by customer, as required by law across the EU (the first plan was simply illegal).

The final result is not known yet, as subsidiaries of those banks in Russia and the UK could not be closed, and therefore we can expect quite a lot of money being withdrawn by Russian and English clients. The western media is talking a lot about Russian mafia or oligarch money in Cyprus, proving once again a lack of objectivity. Oligarchs and mafia moved money out of Cyprus long ago, to other safer places like UK, Luxemburg and others. Foreign depositors hit in Cyprus are mostly high middle class Russian individuals and SME companies doing business with the EU, as well as many ex-USSR, UK and Lebanese individuals (Cyprus has 320,000 registered companies for a population of 180,000)!

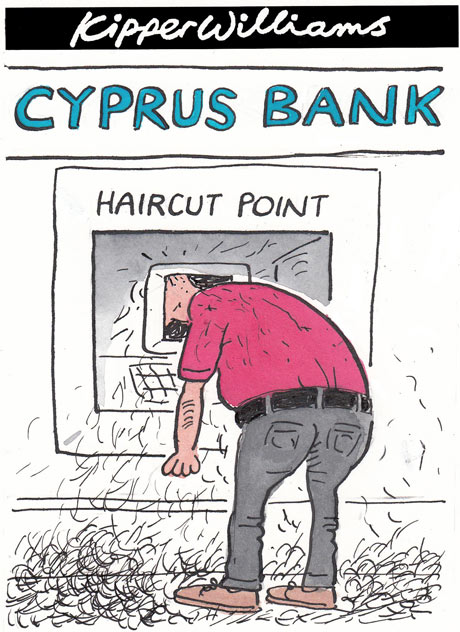

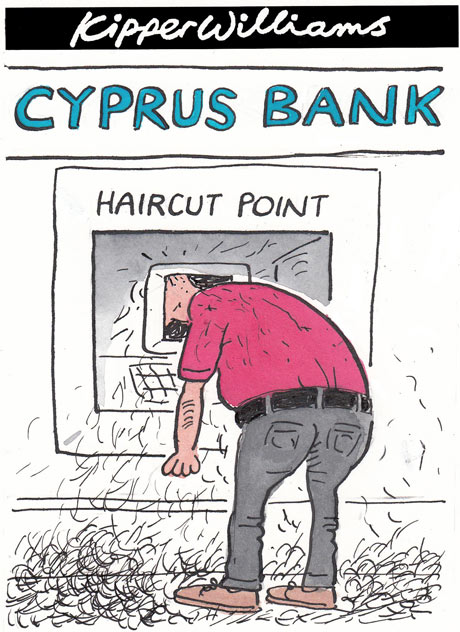

With large deposits at Bank of Cyprus now being said to be hair-cut between 37.5% and 60%, the rest being frozen six months before being “returned” to the depositor, this looks more and more like a full default, a la Iceland. Looking at the positive situation in Iceland now, it may be a good sign for Cyprus, but only if it leaves the Euro zone fast…

The whole story demonstrates several things :

- the panic within EU/IMF top leaders, giving a good reason for all depositors in Europe to become very suspicious (rightly so) about the safety of their deposits, even small.

- the fanatic resolution of EU leaders to avoid having a country leaving the Euro zone, whatever the cost may be

- Russia did not want or could not bail-out Cyprus to get it into the Russian sphere of influence. A major reason I forgot in my previous letter is the importance of UK/NATO military basis on the Island, on top of a strong opposition by Turkey. By the way, the Russian government is now actively using the case to reinforce its move to get rid of off-shore business models, and the fact that money can be lost – even in Europe – shall help a lot!

What should we expect now?

- Cyprus shall have problems to maintain its banking activity and the role of hub for Russia/ex USSR/Lebanese business with Europe, at least in the short term, although I am more optimistic for the long term (see the Iceland case)

- the Greek situation shall get more difficult soon

- countries in a situation comparable to the one of Cyprus are next to come : Malta, Slovenia at first, then Luxemburg, Spain and Italy

If you have money in banks in the EU, the moves to be on the safe side – although not 100%, as rules can be arbitrary changed – should be :

- no account above 50,000 Euros in each bank (the 100,000 euro guarantee cannot fully work in larger countries)

- remember there is NO guarantee for non EU currencies like US$ or Swiss Franc

- check the legal details in the country you have the money – there are local variants!

- do not believe what your banker tells you

- invest in gold, art, old wine or good quality real-estate

- have fun and spend the money!