Luc Brunet – 13 October 2010

Since the beginning of the crisis in 2008, we all read and heard many theories and explanations about how and why did we ended-up in that situation. I was never really happy with the things I have seen, all of them being in general too limited in scope, for example focusing in many details on how Derivatives were created and sold without control by Banks, or how Credits were given to people without control in the US, etc. In this Letter I shall try to humbly give a tentative scenario of what happened and why. Such a tentative shall of course be partial and cannot take into accounts all parameters, events, criteria, hazards and situations that contributed to the result we see today. There are thousands of them and some of them are unknown by the general public, and even by well-informed observers. However I give it a try today and I hope you shall find it useful, also as a basis for more thoughts. As always your comments are welcome!

We have to start our analysis many years back to understand the evolution that took place in our economic and political environment. We also need to take into account many elements that are not only from the world of Banking and Economics, but of course in the area of Politics, Sociology, individual and mass Psychology, Communication and its sister Propaganda, just to name the most important ones.

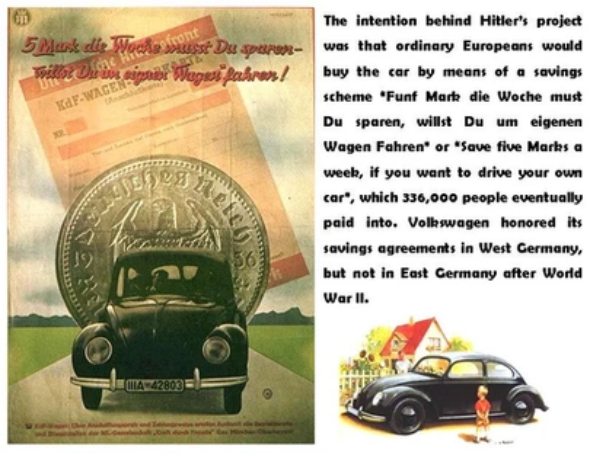

Let’s start with the period generally called the Golden 30’s. This is the time after WW2, that brought a long period of prosperity to the Western World, mainly US and Western Europe. It was a time of relative economic stability, although not lacking international tensions and issues with the Cold War against Communist countries and its culmination with the Cuba crisis that almost started WW3 in 1962. Such stability and growth was based on the development of a new type of human being: the Consumer. That development started somehow before WW2, mostly in the US and in Nazi Germany (for example with the Beetle, the car of the People – Volkswagen, including a credit scheme to finance it), while other European countries were still behind, although some tendencies started to be seen, like the “Holidays for All” in France during the Popular Front period, when workers and employees started to benefit from paid vacations (les congés payés).

The significance of that new player, the Consumer, comes from its large number. This is the first time in history when consumption, entertainment and fun was not reserved anymore to a very small elite, be it nobility or wealthy bourgeoisie, but to masses. This is the development of the “Middle Class”, involving a very large and growing part of the population.

The new Middle Class got the fruits of a growing economy based on technologic development and the successes of mass production. The very spirit of that creation of the 20th century can be found in the phrase of a person who could really claim to be named a Father of the Middle Class, Henry Ford. He is quoted saying “One’s own employees ought to be one’s own best customers. Paying high wages is behind the prosperity of this country.” Although nobody shall ever know if he did it intentionally or just wanted to maximize profits for his company, the result was there!

With a Middle Class getting better off and a sense of “social elevator”, where parents were in most cases able to raise children that would be better off, and sometimes much better off than they were themselves, the economy of those countries grew fast and generated a brand new type of production and distribution. Mass production (but still local!), creative design, lower prices became the key elements of growth, combined with a strong R&D activity and a new type of business: advertising. R&D was also kept local, with the US and Germany being the undisputed leaders of innovation, with products that were not even dreamed of a few years before, like the vacuum cleaner, the washing machine, pampers, the record player etc. Advertising as a new “Science” also developed fast, with a boom in Europe in the 70’s with the wide diffusion of TV sets in almost every household. Political and economical efforts were centered around that Middle Class and intended to make it more comfortable and ready to buy more, for example with the creation of “social nets” including health insurances in most countries (even in the US in many respect!), pension funds, unemployment insurances etc. Credits by banks were also developed, together with the introduction of credit cards (later in Europe, much later in Germany) to stimulate consumption and make “life better”.

Keynes versus Friedman

Interestingly, that Golden period was also a period of strong financial control: monetary control, limitation or interdiction of direct investments by foreign companies, capital flow controls etc. The Bretton-Woods system was in place since the end of WW2, a well negotiated monetary agreement with the key involvement of the famous economist John Maynard Keynes, defining a stable and regulated financial order, tying all members’ currency to the US$, itself fully convertible in gold. Banks were also under the Glass-Steagall Act in the US, and in Europe under similar regulation, making a clear cut between commercial banks keeping savings of individuals and giving consumer credits, and investment banks. Trade deficits between countries were also limited due to the universal indexation to gold, country A having to transfer gold or its equivalent in US$ from their national reserves to countries B in case of trade deficit from A towards B. Such regulations were of course a limitation to business growth, but ensured stability and the absence of those wide imbalances between countries that played a terrible role in the starting of WW1. It seemed that Humans had learned the lessons from History. But Bretton Woods started to explode in 1971, when Richard Nixon unilaterally terminated the gold convertibility of the US$. The main reason was a strong trade deficit largely due to the cost of the Vietnam war, but also to increasing import, notably of oil, when US oil production started to drop. There is no such thing as stability for ever in the world, and changes are continuously introduced in the ecosystem, be by nature or by man. Trends emerged during that period towards a more liberal, or even ultra-liberal approach of the economy, its most famous advocate being Milton Friedman and his “Chicago school”. Such ideas were absolutely not new, and have been firstly developed at the end of the 18th century by people like John Loke, Adam Smith or Thomas Malthus.

Friedman recommends free trade, free movement of capital and the desire to reduce the influence of governments on the economy to a very minimum, if not to zero. Advocates of that theory believe that markets are self-regulating and no counter power should interfere with them. The 19th century was a time of experimentation for those ideas and as mentioned above, generated large trade imbalances at the beginning of the 20th century, that played a key role in the start of WW1. Of course I simplify things a lot here, but basically trade imbalances can be solved by war when a creditor country decides to recover its money by invading the debtor country and confiscate assets as a compensation. Such situation happened several times in history with the US or Western European countries invading South American or African countries just to do that.

Friedman and Keynes had very different views, with Keynes supporting local production and some level of protection of local economies against the “market”. If you read this Letter since some months, you understand that I believe in Keynes more than in Friedman! For me, believing that Markets are self-regulating and can decide what is good for an economy or a region is like believing that the Soviet planning system (Gosplan) could know and decide how the economy has to be run and production be tuned. In both cases, people involved have no clue, and/or do not care, their only goal being to be promoted in the party hierarchy in one case, getting a bigger bonus at the end of the year in the other. In case you wish to get a short overview of Keynes and Friedman thoughts, I recommend two documents (see links at the end of the Letter). The renewed liberal school of economics gained momentum and connected to many other countries and universities. Friedman was part of the Reagan team in the early 80’s and was one of the key brains behind “reaganism’ and “thatcherism” governing guidance, advocating for a limited influence of government on economy, maximum privatization and minimum taxes. At international level, the push was for total freedom of capital flow and investment between countries, going together with the abolition of all “old fashioned” protectionist measures to limit the flow of goods with custom duties or quotas. The GATT organization (General Agreement on Tariffs and Trade) was at that time working for more trade freedom (certainly rightly at the beginning), then replaced by the WTO in 1993. Another political event happened that helped such theories to gain even more popularity, to the point of becoming the “main stream” economical thinking – this is the fall of the USSR and the end of the Cold War, symbolically initiated at the time of the picture below, when Russia’s Yeltsyn gave orders to USSR’s Gorbachev…

The event generated a wave of enthusiasm, and the feeling that Capitalism had won for good and could now reach maximum speed without fear nor complexes. As brilliantly wrote (at least for the form) Francis Fukuyama: “What we may be witnessing is not just the end of the Cold War, or the passing of a particular period of post-war history, but the end of history as such: that is, the end point of mankind’s ideological evolution and the universalization of Western liberal democracy as the final form of human government.” For me, this sentence expresses a feeling of relief and victory that is no more prophetical than the popular expression “La Der des Ders” (in English, the last of the last [war]), used in France after WW1 to name that terrible war! Staying in the ex USSR, the Chicago school economists were promptly sent to Moscow to bring the good word to the new Yeltsin government and are not unrelated to the “wild” period of privatization and liberalization that took place in Russia in the 90’s, ending up with the raising of “oligarch” billionaires and the dramatic default of 1998. Their influence largely ended after the election of Vladimir Putin in 2000, and the return to a more Russian centric governance. But coming back to the US and Western Europe, the considerable growth of the Golden years continued over the end of the 80’s and the begin of the 90’s, still based on the further development of the purchasing power of an expanded middle class, and more and more on a “consumerism” model, where consumers did not only buy fundamental products to increase their quality of life, as in the 60’s and 70’s (family car, washing machine, etc), but more and more for purely comfort items that were heavily advertised to the crowds (second/third car, second/third TV set, country house, cream for this, cream for that, pet food… the list is endless, and I do not even mention cigarettes!). Consumer credit was also more largely used in the US and in several European countries like France. So the model of the Golden years was still working and sustainable, but was already under stress and a new danger was showing up.

Delocalize or die

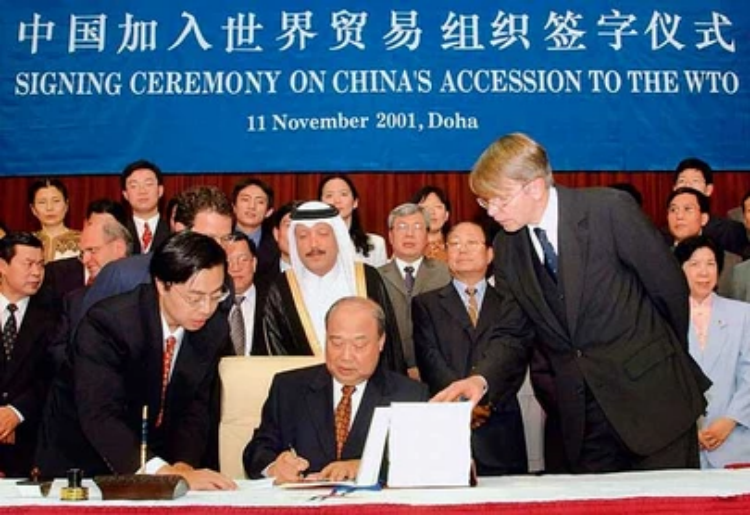

Large corporations in the 90’s started to intensively use the new freedom in international capital and investment flow between countries. Obviously a way to increase profit is to reduce production cost. When I mention the increase of profit, I also have to be completely honest and add that reduction of production costs also served the interest of consumers, and sales prices also were impacted and reduced in the process. The goals of Corporation were twofold indeed – on one side reduce end-user prices to reach more customers even in the lower layers of the middle-class, on the other side increase or at least maintain the profit level. Automation was the first way to achieve that goal, but it obviously had limitations in low technology segments. The free trade agreements helped to reach a further reduction of production cost, this time through the transfer of production sites (manufacturing plants) from high level salary countries to low level salary countries. As long as the difference in salaries was large enough to more than compensate for the cost of transport of goods to the country of consumption, the goal was met. Here again the timing helped, with the opening of China to capitalism and to world trade in general. The country became the major partner for western Corporation that moved an enormous quantity of production capability to that country. Lobbying was strong to have China joining WTO, and this finally happened end of 2001 (in Doha, what a symbol!), although conditions for joining were by far not all met. More waves of delocalization took place, ultimately leading to the deindustrialization of the US and the UK, and to some extend of other European countries, at the notorious exception of Germany that decided by preference and historic instinct to delocalize a limited amount of production to closely located former communist countries.

But delocalization had a rapid effect on the society of Western countries: the erosion of the middle class, and of the living standard of the middle class. That level of living was already under stress due to other trends, like the aging of the population or inflation in some countries, and the result was at best a stabilization of available revenues per family, at worst a decrease. It means the engine of growth that was the middle class started to stop playing its role. Something had to be done, and here comes the credit tsunami! This is an important moment and I would like to stop for a while on that, and introduce some “moral” considerations, although I shall prefer another wording later. Credit provided by a bank to a consumer or a company equals a creation of money, of course not cash money, but monetary mass (M1) increase, and this is technically fine, and by the way one of the corner stone of the success of capitalism. However, and like in all areas of life, I believe any action has to be linked to a legitimate real life purpose and this is where I believe we touch the real cause of today’s crisis. Credits given to consumers in the Golden years were in my views legitimate (read “moral”) because they respected few simple criteria:

- there was a strict control by banks, asking for a significant down payment (sometime 30% of total value), and carefully verification of customer’s income and payment capability, bringing the chances of failure (impossibility to pay back) to a very small level;

- the goods were for real use by the customer, and not for speculation;

- the goods, even in case of default of the customer, can be resold at good value on the market.

This is where the system really blew it up. After years of lobbying by the finance sector, political leaders gave up on the control and allowed banks to mix commercial and investment business with the abolition of the Glass-Steagall Act. Why such a lobby and why such an impact? Very simple I believe. Increasing the level of consumer credit for a middle class on its way to pauperization (loss of purchasing power) is a no go if the existing rules and controls were to remain in place. Maintaining consumption level and grow was only possible if first credits could be given more easily to the middle class, second if credits could also be given to people with very low or instable income (below the middle class in revenue terms). In both case this means an increase in risks and therefore the need to avoid legal constraint in terms of credit control. It is clear that pure commercial banks, as they operated under Glass-Steagall Act, could never be able to survive such practice. However, merging commercial and investment operations made it possible by merging business of different marginality : even if commercial side loses money, it can be concealed by very profitable investment side. Additionally, a more liberal regulation of the investment banking side also allowed to limit the risk with the general use of Derivatives, including OTC (between banks, without central clearing by a an Exchange for example), that made it possible to repackage and resell risky loans, thus completely defusing the risk within the world-wide financial system. The whole concept was further supported by a very low interest rate set by the FOMC in the US, bringing the cost of money to almost zero.

Well, computers are also responsible after all…

And here again another external evolution contributed to the amplification of the issue: the progress of computer technology. With the development of powerful PC’s, fast networking technology, Internet, a large number of applications were developed for the financial markets, allowing computer programs to assess the market based on complex algorithms and take buy/sell decision within a second, construct complex Derivative products that nobody can really understand, allow a private person in Austria to invest in a company in Argentina on Monday and sell on Tuesday, and more critically give powerful tools to brokers and bankers that they themselves could not fully understand or control. This is where I want to come back to my concept of legitimate value creation through credit. The last 10-15 years have been dealing with what I consider as non-legitimate value creation. A credit given to a person with almost no stable revenue, with zero down payment, spread over 40 years, with an adjustable interest rate is not and shall never be a legitimate value creation. The same goes for loans provided to investment funds in order to speculate on stock, treasuries or other financial tools. All that does not correspond to any real world goods, only to speculative (bubble type) investment.

By the way, the US had a way to “re-legitimate” part of those assets in 2008, and that was to decide by authority to cancel the risky loans and transfer the property of the houses to the customers without additional payment. Yes I know, the terms of such a move would have been terrible to administer and the move was totally against the principles of liberal capitalism, but… billions of value would have regained legitimacy and the downwards spiral of real-estate prices would probably have stopped, although most banks would have been bankrupted and nationalized. For sure, a bold decision, that nobody could take in such a politically deadlocked country! To be complete on this overview of the crisis’ background, we have to spend some time looking at what happened in Europe. In that case, the key event is on my views is the creation of the Euro in 2002. For the first time in history, a single currency was created across a number of countries with different tax, legal, social and political background, while keeping a level of monetary control at country level, as each country continued to operate its own Central Bank. Many people at that time claimed that a political and fiscal union was really needed, but nothing happened. Over the years, the old danger of budget deficits started to show up again, where southern Euro countries started to run into deficit against northern Euro countries, fueled by common low interest rate, unprecedented in the southern countries (de facto a subprime scheme but at country level). And as everybody was in the Euro zone, southern countries did not have anymore the possibility to compensate with a devaluation of their currency. Here again we can somehow talk about non-legitimate created value (advanced infrastructure built in countries with a corrupt and non-transparent system governance and a low productivity level). The decision by governments to save large banks in 2008, at the image of the US move, and at the cost of more sovereign debt, added to the disaster and made it irreversible.

What now?

At some moment in the Letter you may have got the impression that I describe a well-designed scenario, created by top bankers or corrupt politicians.. but I do not believe in such plans, and in general in conspiracy theories. I believe more in a combination of greed, incompetency, opportunistic behavior, corruption and bad luck! I also do not believe a specific group of people are responsible for what happened, and I see more a collective responsibility, although some hedge-fund managers, bankers or corrupt politicians may have sooner or later to respond for some more concrete actions they took. We all played the game and took at some stage advantage of it : poor people in the US took credit to buy houses they could not afford, wealthy pensioners signed up for investment fund or life insurances convinced they could get 11% a year without risk, populations of Southern Europe enjoyed the low interest rate after the Euro was introduced without asking questions, pension funds and investment funds continued to buy sovereign debt from countries that are rushing to default…. but there is no free lunch. All this reminds me of a book I read many years ago, “Die letzten Tage der Menschheit” (The Last Days of Mankind) by Austrian satirist Karl Kraus (1874-1936). The book tells about how people in Vienna lived during WW1, far from the front and in a state of pure virtual reality, very close to what we feel today when we listen to politicians or economists, and just like today, the feeling is that nobody is responsible for what happened … or maybe everybody!?

– John Maynard Keynes, “National Self-Sufficiency”

https://www.mtholyoke.edu/acad/intrel/interwar/keynes.html

– Milton Friedman “The Social Responsibility of Business is to Increase its Profits”

http://www.colorado.edu/studentgroups/libertarians/issues/friedman-soc-resp-business.html